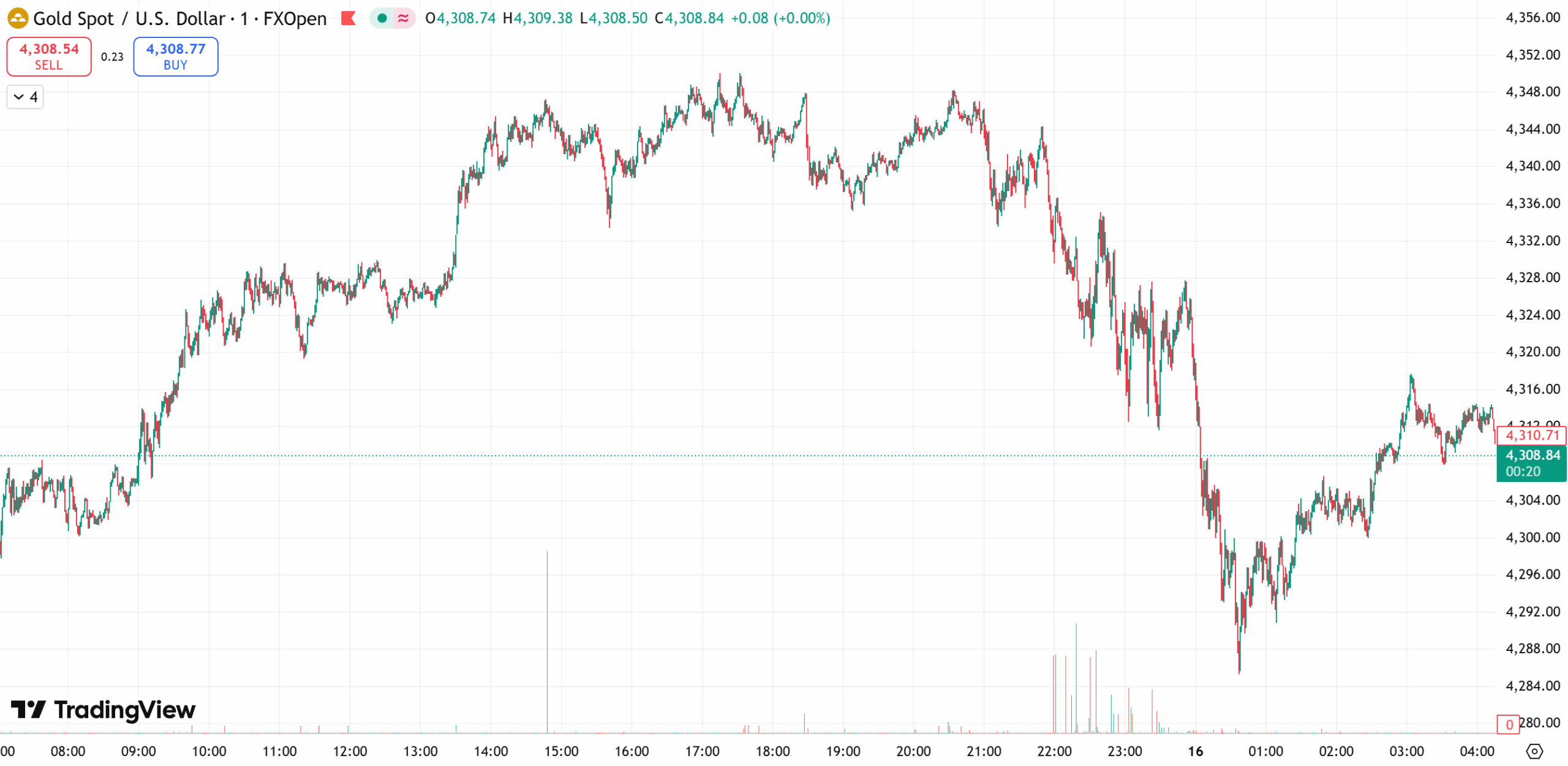

Tuesday, spot gold traded near $4,307/oz after narrowing earlier gains, as easing geopolitical tensions and profit-taking weighed on prices ahead of the key US Non-Farm Payrolls (NFP) release.

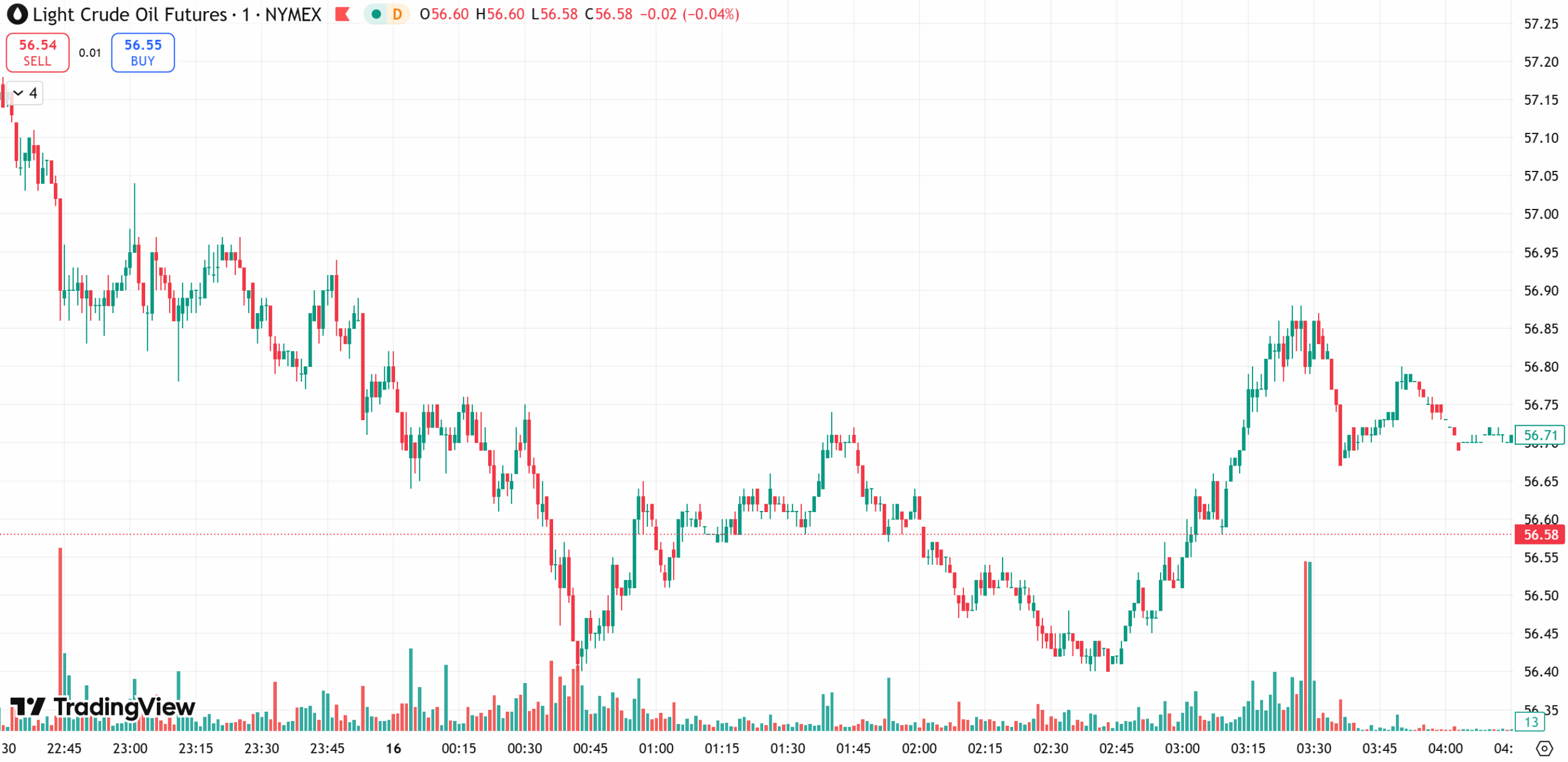

WTI crude traded around $56.63/barrel, extending losses amid strong expectations of a global oil supply surplus in 2026 and progress in Ukraine peace talks.

Gold

Gold trimmed intraday gains on Monday, as investors locked in profits following the recent rally. Spot gold settled at $4,304.91/oz, up 0.11% on the day, sharply below earlier gains of over 1%.

Analysts noted that gold eased after reports suggested progress in talks between the US and Ukrainian President Zelensky, reducing safe-haven demand. At the same time, profit-taking after recent highs added downside pressure.

Market focus has now shifted to upcoming US data, including Non-Farm Payrolls and retail sales, which could offer clearer guidance on the Federal Reserve’s policy path. According to the CME FedWatch Tool, markets are currently pricing a 78% probability of a rate cut in January 2026.

Gold Technical View

On the daily chart, gold remains in a four-session winning streak, with consecutive small bullish candles signaling a steady but controlled uptrend. Bollinger Bands continue to open higher, with upside resistance seen near $4,330–4,350.

On the 4-hour chart, Friday’s US session showed a push higher followed by a pullback, suggesting room for further consolidation rather than a strong one-way move. Near-term support is seen at $4,280, while a deeper pullback could test $4,260. On the upside, $4,350 remains a key resistance zone.

Today’s Gold Focus

- Strategy bias: Buy on dips, sell into rallies

- Resistance: $4,330–4,350

- Support: $4,285–4,265

Oil

Oil prices extended losses on Monday, pressured by growing expectations of a global oil supply surplus in 2026. While rising tensions between the US and Venezuela disrupted some supply flows, these factors failed to offset broader bearish fundamentals.

Brent crude settled down 0.92% at $60.56/barrel, while WTI crude fell 1.08% to $56.82/barrel.

The main driver behind the decline remains expectations of excess supply next year, alongside fading geopolitical risk premiums. Reports suggesting flexibility from Ukrainian President Zelensky in negotiations with the US reduced concerns over potential supply disruptions tied to the Russia-Ukraine conflict.

That said, tighter US sanctions on Venezuela offered some support. Since the US seized oil tankers and imposed new restrictions last week, Venezuelan exports have dropped sharply. Analysts noted that without this disruption, oil losses could have been deeper.

Technical View

From a daily perspective, oil remains in a secondary consolidation phase, with mixed candles and repeated tests toward the $56 area. MACD remains below the zero line, showing weak bearish momentum.

On the 1-hour chart, prices are moving sideways around key moving averages, forming a narrow consolidation range between $56.80 and $58.10. Momentum remains soft, with sellers maintaining a slight edge.

Today’s Focus

- Strategy bias: Sell rallies, buy dips cautiously

- Resistance: $58.0–$59.0

- Support: $55.5–$54.5

Risk Disclosure

Trading Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.